When it comes to handling financial dealings, especially in places like car dealerships, having a clear and dependable way to check someone's credit is, like, really important. It's not just about seeing if someone can pay; it's also about keeping things safe from tricky scams. So, a good credit application process, one that gives you a lot of helpful information, can certainly make a big difference. This kind of application helps businesses protect themselves and also helps them serve their customers better, which is, you know, a pretty good thing for everyone involved.

Right now, in today's fast-moving business world, businesses really need ways to get quick and accurate financial details. This is especially true when people are applying for credit. A system that can give you a full picture, including ways to stop fraud, keep up with rules, and get good customer details, is very valuable. It's about making sure every step, from the first look at a buyer to the final handshake, is as smooth and secure as it can possibly be, more or less.

That's where an informativ credit application comes in handy, actually. It's about getting all the important pieces of information you need, presented in a clear way, so you can make smart choices quickly. This kind of process helps businesses avoid problems and lets them focus on helping their customers get what they need. It really is about making the whole process simpler and safer for everyone involved, you know, for businesses and for their customers too.

Table of Contents

- What is an Informativ Credit Application?

- Why Informativ Matters for Your Business

- The Informativ Difference: Key Features

- Frequently Asked Questions About Informativ

What is an Informativ Credit Application?

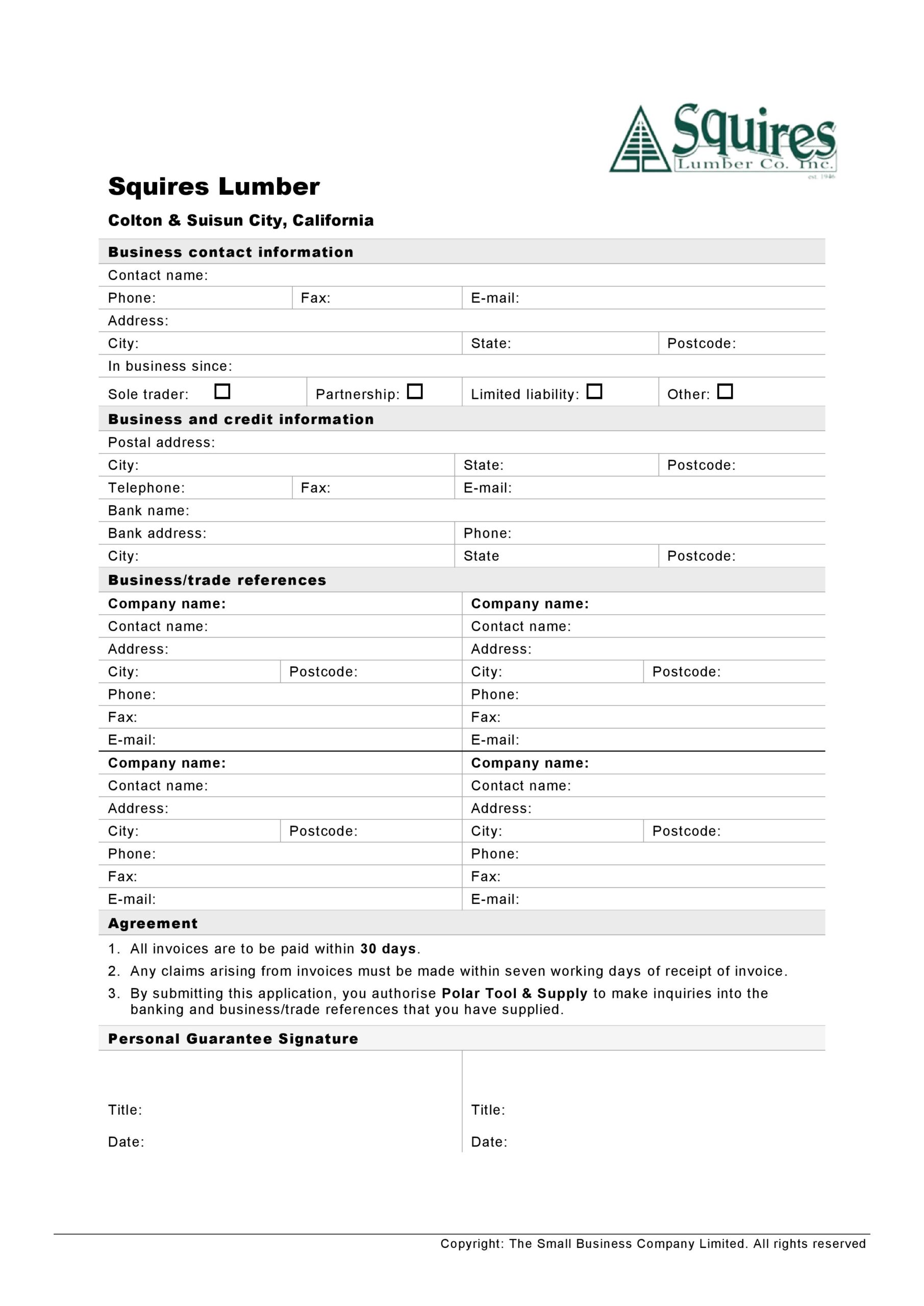

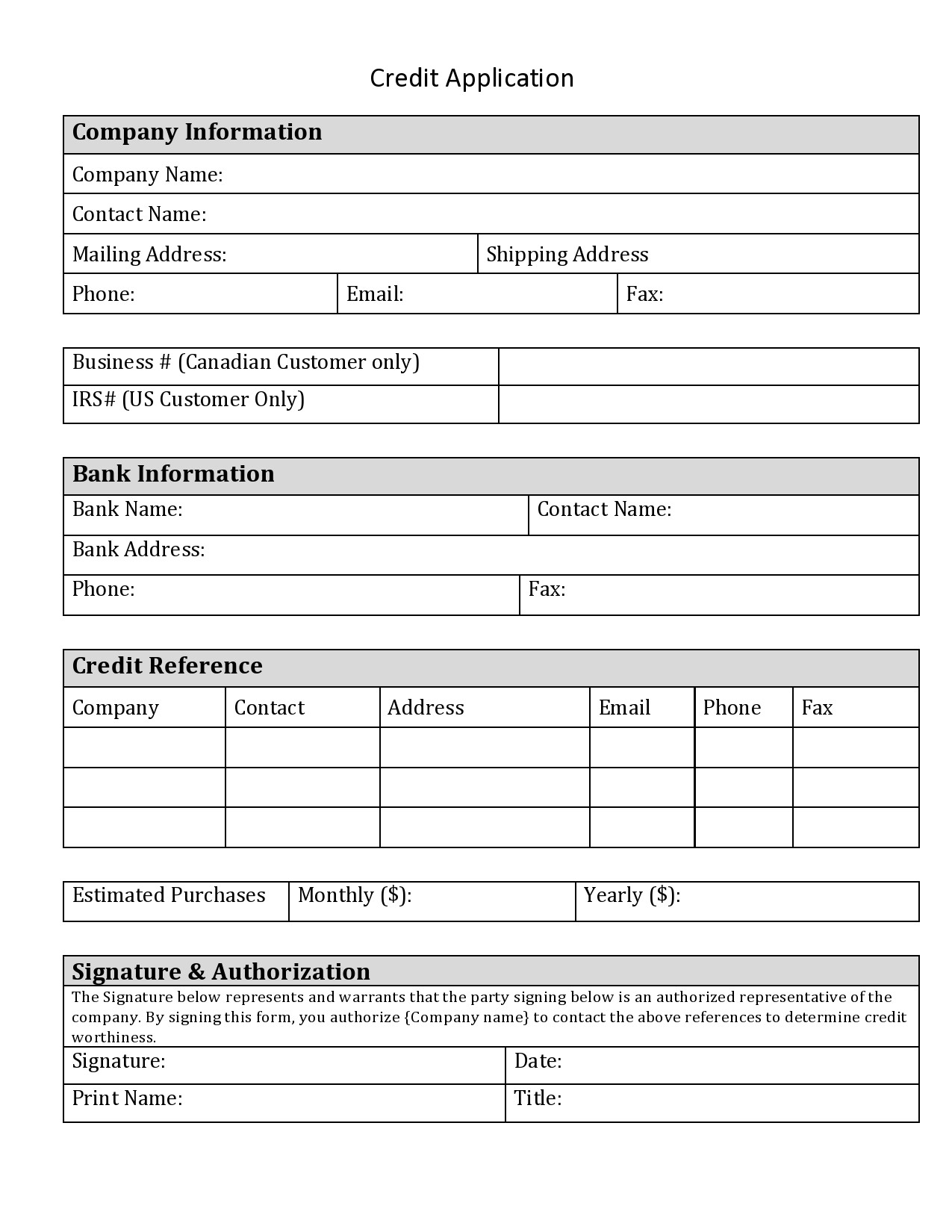

An informativ credit application, when we talk about Informativ's offerings, is basically a very complete system for businesses to handle credit checks and related tasks. It's not just about pulling a credit score, you know. It actually brings together several important tools to give you a full picture. This includes ways to stop fraud, make sure you're following all the rules, and even get a better idea of who your customers are. It's a bit like having a whole team of experts helping you with every credit decision, so it's quite useful.

The main goal is to give businesses, like car dealerships or lenders, all the information they need to make good choices about credit. This means getting details from credit bureaus and also using smart tools to spot any potential problems. It's a proactive way to deal with credit applications, helping businesses stay ahead of issues. So, it really is a pretty broad solution for a lot of common business needs, especially when money is involved.

This kind of application process aims to make things safer and more efficient from the very beginning. It's about protecting a business even before a transaction fully happens, and then also through the whole process. Think of it as a safety net that also helps you understand your customers better. It's a way to handle credit applications that's more about prevention and insights, not just reaction, which is a good thing.

Why Informativ Matters for Your Business

For any business dealing with credit, having a reliable system is, frankly, super important. Informativ offers a complete package that addresses several big concerns for businesses today. It's about making sure your operations are smooth, secure, and smart, you know. This kind of system can really change how a business handles its daily financial interactions, especially those involving new customers. It helps businesses avoid common pitfalls and focus on growth, which is, in a way, what everyone wants.

Stopping Fraud Before It Starts

One of the biggest worries for businesses these days is fraud. It's a growing problem, and it can cost a lot of money and trust. Informativ provides what they call "proactive fraud prevention." This means it helps safeguard your dealership, or any business, even before and during a transaction. It's about catching suspicious activity early, which is, honestly, a huge benefit.

For example, Informativ has a mobile app that can verify IDs in just a few seconds. This quick check can stop many types of fraud right at the start. It's a simple, fast way to make sure the person you're dealing with is who they say they are. So, it really helps to add an important layer of security to your operations, which is pretty reassuring for any business owner, I think.

Having tools that work to protect you from fraud from the very beginning is, you know, a game-changer. It means less risk for your business and more peace of mind. This kind of prevention is much better than trying to fix things after fraud has already happened, which can be a real headache. It's about creating a safer environment for all your financial dealings, in some respects.

Making Credit Checks Simple and Fast

Getting credit information can sometimes be a slow and complicated process. Informativ aims to make this much easier. They bring together tools like CreditDriver and Credit Bureau Connection (CBC) to streamline how businesses get credit details. This means you can get the information you need quickly, which is, frankly, very helpful when you have customers waiting.

A key feature is the ability to do both soft and hard pull credit reports. This flexibility is really useful. A soft pull, for instance, lets businesses prequalify buyers without affecting their credit score. This is great for customers because it doesn't leave a mark on their credit history just for an inquiry. It's a customer-friendly approach that also helps businesses quickly assess eligibility, which is a win-win, really.

Then, when it's time for a full application, a hard pull can be done. Having both options means businesses can match the credit check to the specific stage of the customer's journey. It helps speed up the process and makes it less of a hassle for everyone involved. So, it's about making the credit application process as smooth as possible, which is, obviously, a good thing for sales.

Keeping You Compliant and Informed

Staying on the right side of financial rules and regulations is a big deal for businesses. Informativ is a provider of compliance solutions, which means they help businesses follow the necessary laws. This takes a lot of stress off businesses, as they can be confident they are meeting their legal obligations. It's about having an expert system that keeps you in line, so to speak, with all the latest requirements.

Beyond just compliance, Informativ also offers customer insights. This means they help businesses understand their customers better, which can lead to better service and stronger relationships. Knowing more about your customers can help you offer them the right products and services, making them happier. It's about using data to make smarter business choices, which is, you know, pretty smart.

These insights, along with compliance support, help businesses run more smoothly and effectively. They allow you to focus on your core business, knowing that the important details are being handled correctly. It's a comprehensive approach that looks at both the legal side and the customer side, which is, honestly, very thorough.

Detecting Tricky Identity Scams

One particularly sneaky type of fraud is synthetic identity fraud. This is where fraudsters create a new identity by combining real and fake information. It can be very hard to spot using traditional methods. Informativ's credit solutions are designed to detect this kind of sophisticated scam. This is a crucial capability in today's world, where fraud methods are always changing.

Being able to identify synthetic identity fraud means businesses are better protected against significant financial losses. It helps prevent false accounts from being opened and keeps your operations secure. This specialized detection is a key part of their fraud prevention strategy. It really shows how advanced their system is, which is, you know, pretty impressive.

Protecting your business from these advanced threats is more important than ever. Informativ's ability to spot these complex frauds gives businesses a strong defense. It's about having the right tools to face the challenges of modern fraud, which is, frankly, very reassuring for any business owner, I think.

The Informativ Difference: Key Features

What makes an informativ credit application stand out is the combination of its specific tools and services. It's not just one thing; it's how everything works together. This integrated approach provides a very complete solution for businesses that need to manage credit, prevent fraud, and understand their customers better. It's a comprehensive system, you know, that really covers a lot of ground.

CreditDriver and Credit Bureau Connection

At the core of Informativ's credit solutions are CreditDriver and Credit Bureau Connection (CBC). These components work together to provide accurate and quick access to credit information. Credit Bureau Connection, for instance, helps businesses connect directly to credit bureaus to get the necessary reports. This direct link means the information is reliable and up-to-date, which is, obviously, very important for making good decisions.

CreditDriver, on the other hand, likely helps in interpreting and using that credit data effectively. Together, they form a powerful duo that makes the credit reporting process much more efficient. They help businesses get a clear picture of an applicant's financial situation. So, it really is about streamlining how you get and use credit information, which is, you know, pretty handy.

This integration means businesses don't have to piece together information from different sources. Everything is brought together in one place, making the process smoother and faster. It's a very organized way to handle credit reports, which saves time and reduces errors, which is, frankly, a big plus for any busy operation.

Quick ID Verification with the Mobile App

In today's fast-paced world, speed is everything, especially when verifying identities. Informativ's mobile app is a key part of their fraud prevention strategy because it verifies IDs in seconds. This quick verification process is incredibly useful for businesses like dealerships, where customers expect fast service. It helps keep things moving along nicely, which is, you know, what customers appreciate.

Using a mobile app for ID checks adds a layer of convenience and efficiency. It means staff can quickly confirm someone's identity right on the spot, without needing a lot of extra equipment. This instant verification helps prevent fraud right at the point of interaction. So, it's a very practical tool for everyday operations, actually, making security simple and quick.

This rapid ID check capability is a clear example of how Informativ helps safeguard businesses before and during a transaction. It's a proactive step that makes it much harder for fraudsters to succeed. It really does make the initial steps of any transaction much more secure and efficient, which is, honestly, a big benefit.

Always There to Help: 24/7 Support

Even with the best systems, questions or issues can pop up. Informativ understands this, which is why they offer 24/7 support. This round-the-clock assistance means businesses can get help whenever they need it, day or night. This kind of constant availability is, you know, very reassuring, especially for businesses that operate outside of typical office hours.

Their support team, which previously operated under names like Dealer Safeguard (DSGSS) and Credit Bureau Connection (CBC), is ready to assist. You can contact them for help or to schedule a solutions demo. This continuous support shows a real commitment to helping their users succeed. It means you're never left on your own if you run into a problem, which is, frankly, a huge comfort.

Having reliable support available at any time adds significant value to their services. It helps ensure that businesses can keep operating smoothly, even if a technical issue arises. It's about providing peace of mind and ensuring that the informativ credit application process is always working as it should, which is, you know, what every business needs.

Learn more about credit reporting solutions on our site, and link to this page for more on fraud prevention strategies.

Frequently Asked Questions About Informativ

Can businesses prequalify buyers using a soft pull?

Yes, they absolutely can. Informativ provides the ability for businesses to prequalify buyers by using a soft pull credit report. This is a really helpful feature because a soft pull doesn't affect the buyer's credit score. It allows businesses to get an initial look at a buyer's creditworthiness without leaving a mark on their credit history. So, it's a very customer-friendly way to start the credit application process, which is, you know, pretty smart for sales.

Does Informativ provide both soft and hard pull credit reports?

Actually, yes, Informativ does provide both types of credit reports. They offer both soft pull and hard pull credit reports. This flexibility is quite useful for businesses. A soft pull is great for pre-qualification, as mentioned, while a hard pull is typically used for final credit applications and does appear on a credit report. Having both options means businesses can choose the right type of credit inquiry for each stage of their process, which is, frankly, very convenient.

Can Informativ's credit solutions detect synthetic identity fraud?

Yes, they can. Informativ's credit solutions are designed with advanced capabilities to detect synthetic identity fraud. This is a very important feature given the increasing sophistication of fraud schemes. Synthetic identity fraud, where a new identity is created from a mix of real and fake information, is particularly hard to spot. Informativ's ability to identify this type of fraud provides a strong layer of protection for businesses, which is, you know, pretty vital in today's world.