Figuring out if a certain amount of money is enough to live on can feel like a really big puzzle, especially when you're on your own. Many single individuals find themselves asking, "Is $45k a year good for a single person?" This question isn't just about numbers; it's about what kind of life you can build, the choices you get to make, and the peace of mind that comes with financial stability. It's a common thought, you know, when you're looking at your pay stub and then at the bills.

The answer, quite honestly, isn't a simple yes or no. It really depends on so many different things. Your location, for example, plays a huge role in how far your money goes. What might be a comfortable income in one town could feel like a constant struggle in a bigger, more expensive city. So, it's almost like trying to hit a moving target when you think about it.

This article will help you break down what a $45,000 annual income might mean for a single person. We'll look at the practical aspects, from how much money actually lands in your bank account after taxes to the everyday costs you'll face. We'll also explore ways to manage your funds effectively and perhaps even make that amount stretch further, giving you a clearer picture of your financial landscape, basically.

Table of Contents

- Understanding Your Real Take-Home Pay

- The Cost of Living Puzzle

- Crafting a Workable Budget

- Living on $45k: What Your Lifestyle Might Look Like

- Boosting Your Income: Avenues to Explore

- Frequently Asked Questions

Understanding Your Real Take-Home Pay

When you hear "45k a year," that's usually your gross income, which is the amount you earn before anything is taken out. But what truly matters for your day-to-day life is your net income, the money that actually shows up in your bank account. This difference can be quite significant, you know, and it's where many people get surprised.

Taxes and Other Deductions

A good chunk of your gross income goes towards various deductions. This includes federal income tax, state income tax (if your state has one), Social Security, and Medicare. Beyond that, you might have money taken out for health insurance premiums, retirement contributions like a 401(k), or even union dues. So, really, a $45,000 salary isn't $45,000 in spendable cash, not by a long shot.

What Actually Lands in Your Account

After all those deductions, your take-home pay could be closer to $3,000 to $3,500 per month, or even less, depending on where you live and your specific deductions. For instance, in a state with high income taxes and costly health insurance, that $45,000 could shrink pretty fast. It's a very important number to calculate for your own situation, as a matter of fact, because it dictates your real spending power.

The Cost of Living Puzzle

The biggest factor in determining if $45,000 is a "good" income for a single person is undeniably the cost of living in their area. Some places are just naturally more expensive than others, and that has a massive impact on your budget. It's a bit like playing a different game depending on the board you're on, so to speak.

Where You Call Home Really Matters

Think about it: renting a small apartment in New York City or San Francisco is vastly different from renting a similar place in a smaller city in the Midwest or the South. Housing costs alone can eat up a huge percentage of your income. So, if you're in a high-cost area, $45,000 might feel quite tight, but in a lower-cost region, it could provide a fairly comfortable existence, you know.

Housing: Rent or Ownership Dreams?

For most single people on a $45,000 salary, renting is the more common path. General advice suggests spending no more than 30% of your gross income on housing. For $45,000, that's about $1,125 per month. Finding a decent place for that price can be a real challenge in many urban centers today, especially if you want to live alone. In some areas, you might need roommates just to make rent affordable, which, actually, changes the whole dynamic of living solo.

Getting Around: Transportation Expenses

Your commute and daily travel habits also play a big part. If you own a car, you'll have car payments, insurance, fuel, and maintenance costs. These can add up quickly, sometimes hundreds of dollars each month. If you rely on public transportation, the costs might be lower, but still a regular expense. Being able to walk or bike to work, for example, can save you a significant amount of money, which is pretty neat.

Filling Your Plate: Food and Groceries

Food is another essential budget item. Cooking at home is almost always cheaper than eating out frequently. A single person might spend anywhere from $200 to $400 a month on groceries, depending on their dietary habits and whether they shop smart. Dining out, getting takeout, or grabbing daily coffees can easily push this number much higher, you know, making a real dent in your budget.

Keeping the Lights On: Utilities and Bills

Beyond rent, there are utilities: electricity, gas, water, internet, and maybe trash collection. These vary depending on your usage, the size of your living space, and the climate. Don't forget your cell phone bill, too. These are non-negotiable expenses that, basically, come every month, so you have to factor them in carefully.

Staying Well: Healthcare Costs

Even if your employer offers health insurance, you'll likely have premiums, deductibles, co-pays, and out-of-pocket expenses. If you're responsible for your own insurance, the costs can be quite high. This is a very important area to consider, as unexpected medical bills can really throw a budget off track, you know.

Managing What You Owe: Debt Payments

Student loans, credit card debt, or other personal loans can take a substantial bite out of your monthly income. Managing these payments effectively is crucial for financial health. If you have significant debt, a $45,000 salary might feel much tighter than for someone without these obligations, obviously, so that's something to think about.

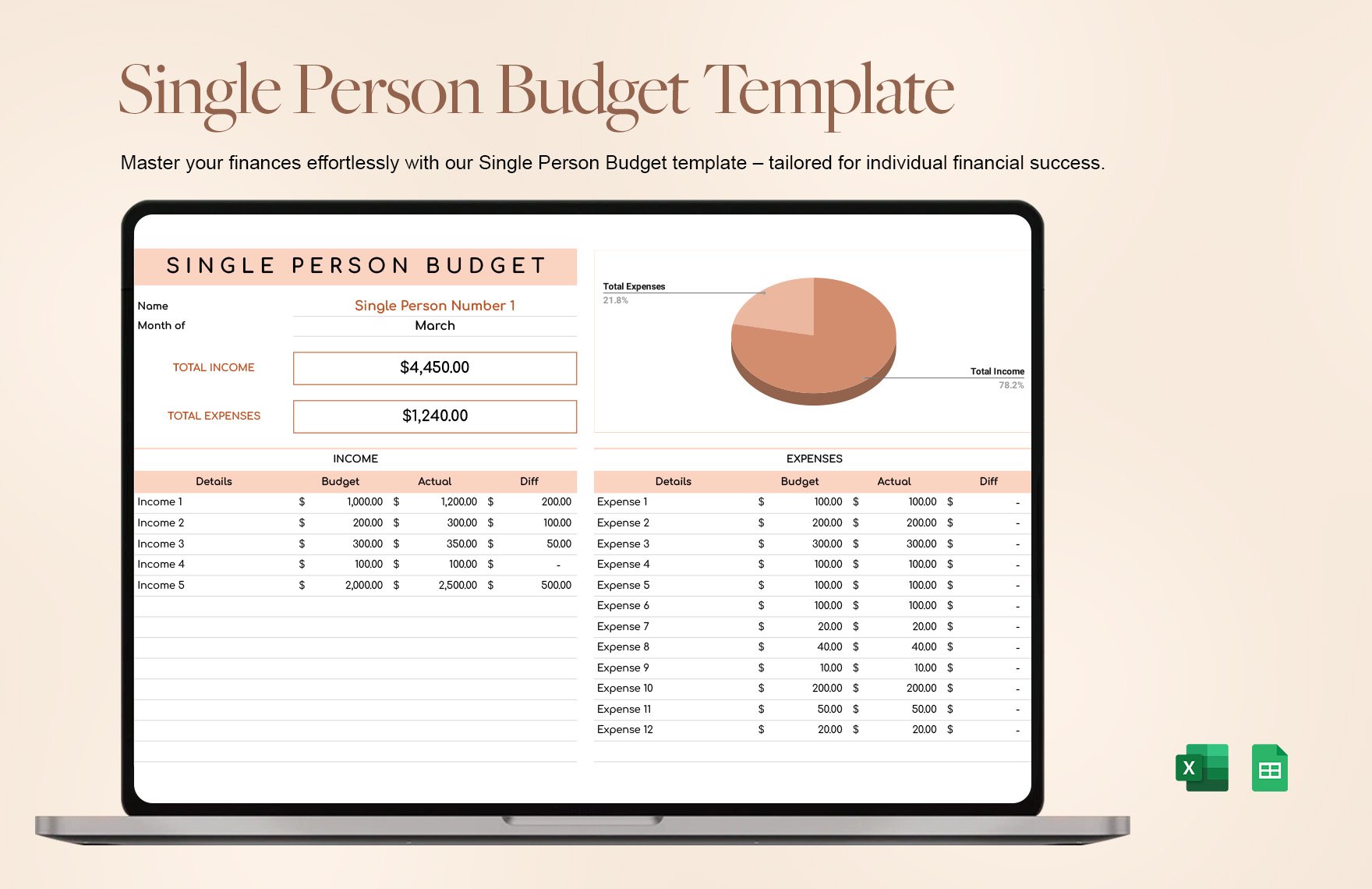

Crafting a Workable Budget

Regardless of your income level, having a budget is like having a roadmap for your money. It helps you see where your cash is going and where you can make adjustments. It's truly a powerful tool for financial control, and, honestly, it's not as scary as it sounds.

The 50/30/20 Guideline

A popular budgeting rule is the 50/30/20 rule. This suggests allocating 50% of your after-tax income to needs (housing, utilities, food, transportation), 30% to wants (entertainment, dining out, hobbies), and 20% to savings and debt repayment. For a single person on $45,000, this framework can be a really helpful starting point, providing a good structure, you know.

Keeping Tabs on Your Money

To make any budget work, you need to track your spending. This can be done with a simple spreadsheet, a budgeting app, or even just a notebook. Knowing exactly where your money goes helps you identify areas where you might be overspending and where you can cut back. It's like shining a light on your financial habits, and it's actually quite revealing.

Uncovering Places to Save

Once you see your spending patterns, you can look for opportunities to save. Maybe it's cutting down on subscriptions you don't use, cooking more meals at home, or finding cheaper entertainment options. Every little bit truly helps build up your financial resilience. Even small changes can make a big difference over time, you know, which is pretty encouraging.

Living on $45k: What Your Lifestyle Might Look Like

So, what kind of life can a single person expect on $45,000 a year? It's certainly possible to live comfortably, but it often means being mindful of your choices and prioritizing your spending. It’s not about deprivation, but about smart allocation, basically.

What Sort of Life is Possible?

In a lower-cost area, $45,000 can provide a pretty decent standard of living. You might be able to afford your own apartment, enjoy social activities, and even save a bit. In a higher-cost area, you might need to make more compromises, perhaps living with roommates, relying heavily on public transport, or limiting discretionary spending. It's a very different picture depending on your postcode, so.

Making Choices and Sacrifices

Living on this income as a single person often means making conscious decisions about your wants versus your needs. You might not be able to afford frequent international travel or brand-new luxury items. However, you can still enjoy experiences, pursue hobbies, and build a fulfilling life. It's about finding joy in what you can afford and being creative with your leisure time, which is actually a valuable skill.

Building a Financial Safety Net

One of the most important steps for anyone, especially a single person, is to build an emergency fund. This is money set aside for unexpected expenses like medical emergencies, car repairs, or job loss. Aim for three to six months' worth of essential living expenses. Having this safety net can provide immense peace of mind, you know, and prevent you from going into debt during tough times.

Planning for Tomorrow: Saving for the Future

Even on $45,000, it's wise to start thinking about long-term savings. This includes retirement, a down payment on a home, or other major life goals. Even small, consistent contributions can grow significantly over time thanks to the power of compounding. It's a bit like planting a tree; the sooner you start, the bigger it grows, obviously.

Boosting Your Income: Avenues to Explore

If $45,000 feels a bit tight, or you simply want more financial flexibility, there are ways to increase your earnings. This isn't always easy, but it's certainly possible with some effort. You know, sometimes you just have to look for those extra opportunities.

Extra Work on the Side

Many people supplement their main income with a side gig. This could be anything from freelancing in your area of expertise, driving for a ride-share service, or selling crafts online. Even a few hundred extra dollars a month can make a significant difference in your budget and savings goals. It's a pretty common way to get ahead these days, actually.

Growing Your Abilities

Investing in yourself through new skills or further education can open doors to higher-paying jobs. Online courses, certifications, or even a part-time degree can boost your earning potential over time. This is a long-term strategy, but it can pay off immensely, providing a solid foundation for future growth, you know.

Asking for More Money

Don't be afraid to negotiate your salary when starting a new job or ask for a raise at your current one. Do your research on average salaries for your role and industry, and be prepared to highlight your contributions and value to the company. Sometimes, simply asking can yield positive results, which is, honestly, a lesson many people learn later in their careers.

Frequently Asked Questions

People often have specific questions when considering an income of $45,000 a year for a single person. Here are some common ones:

Is $45,000 a good salary in [specific city/state]?

This really depends on the specific location. For example, in a major metropolitan area like New York City or Los Angeles, $45,000 would likely be considered quite challenging for a single person to live comfortably, possibly requiring roommates or a very frugal lifestyle. However, in a lower-cost state or a smaller city in the Midwest or South, it could provide a decent, manageable living. You'd need to research the average cost of living for housing, transportation, and groceries in that exact place to get a true picture. So, it's a very localized answer, basically.

How much rent can I afford on $45,000 a year?

A common financial guideline suggests that housing costs, including rent and utilities, should ideally not exceed 30% of your gross income. For a $45,000 annual salary, that would mean a maximum of about $1,125 per month for rent. However, after taxes and other deductions, your actual take-home pay might be closer to $3,000-$3,500 monthly. So, sticking to 30% of your *net* income (around $900-$1,050) might be a more realistic and financially healthier goal for rent, allowing more room for other expenses and savings. It's important to be honest with yourself about what you can truly manage, you know.

Can you buy a house on $45k a year?

Buying a house on $45,000 a year as a single person is quite challenging in most parts of the United States today. Mortgage lenders typically look for a debt-to-income ratio that allows for comfortable monthly payments, and a $45,000 salary usually translates to a limited mortgage amount. You would likely need a significant down payment, qualify for specific first-time homebuyer programs, and be looking in very low-cost housing markets. Even then, the ongoing costs of homeownership like property taxes, insurance, and maintenance can be substantial. It's not impossible in every single location, but it's certainly a difficult path for most, honestly, given current housing prices. Learn more about managing your money on our site, and find tips on budgeting effectively on this page .

Ultimately, whether $45,000 a year is "good" for a single person is truly personal. It's about your priorities, where you choose to live, and how diligently you manage your money. With careful planning and smart choices, you can absolutely build a stable and enjoyable life on this income. It just takes a bit of thought and discipline, you know, to make it work for you.